debt limit resolutions: setting the new precedents that lead to the chaos

May 16 was the first deadline; August 2 is the second deadline. The first was passed over, after the whole brass in the Treasury warned not “to play games with this”. After August, the Economy will go into a tail-spin. So the prediction goes.

Of course, the danger always lays in the precedent of becoming lax to the deadline. That was probably the case once upon a time with semi-arbitrary figures of debt numbers and deficit numbers. Pass a trillion — one can just go on ahead.

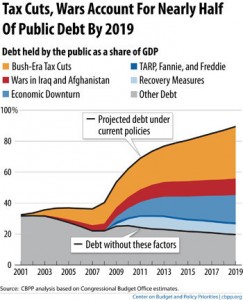

Once upon a time a George H W Bush raised top marginal taxes. Then Bill Clinton did. That and some spending cuts and a robust economy produced a balanced budget. Then this happened:

Various organizations have come in to put big money in stopping any hint of a tax cut. It is large enough that Obama came face to face with the idea that the Bush Administration tax cut expiration was unfeasible against the newly elected Republican Congress — a new precedent has been drawn on proceeding ahead on how to solve the problem.

For “Clean Debt Limit” purposes the Republican House gives this bill:

4 The Congress finds that the President’s budget pro5

posal, Budget of the United States Government, Fiscal

6 Year 2012, necessitates an increase in the statutory debt

7 limit of $2,406,000,000,000.

‘Tis a partisan game. Generally measures meant to be passed refrain from partisan gamesmanship in favor of straight forward language. And we’re back to the Treasury’s warning about “Playing Games.” Not that it matters all that much: something will get passed. It’s just that unlike last time, a milestone in “playing games with the debt limit” was passed — up against the second deadline instead of the first — and is a new barometer. (Whether it was necessary in order to curb the other guidelines I guess you can leave up to the Tea Party meanderings.)